Ever stared at a vandalized car, your credit card statements piling up, and wondered, “What do I even do now?” Yeah, us too.

Navigating the world of vandalism insurance while managing credit card payments can feel like deciphering an ancient scroll. But here’s the good news—you’re not alone. This guide will walk you through everything you need to know about legal recourse for vandalism claims, especially when credit cards are involved. By the end of this post, you’ll understand:

- The importance of vandalism insurance

- How to file a claim step-by-step

- Tips for maximizing your claim payout

- FAQs to help settle disputes or concerns

Table of Contents

- Key Takeaways

- Understanding Vandalism Insurance

- Step-by-Step Guide to Filing a Claim

- Best Practices for Smooth Legal Recourse

- Real-Life Examples & Case Studies

- Frequently Asked Questions (FAQs)

- Conclusion

Key Takeaways

- Vandalism insurance protects against malicious property damage.

- Credit cards may offer additional protection—check your terms!

- Filing a claim involves documentation, patience, and persistence.

- Maximizing payouts requires thorough evidence and proactive communication.

- Knowing your rights is half the battle; ask questions if unsure.

Understanding Vandalism Insurance: Why It Matters

Vandalism insurance is that unsung hero policy that kicks in when someone damages your stuff on purpose. Maybe it’s graffiti on your garage door or slashed tires on your car—this coverage ensures you’re not stuck footing the bill entirely out of pocket.

“Optimist You:” *This sounds awesome! Someone slashes my tire? Insurance has got me covered.*

“Grumpy You:” *Yeah, but only after jumping through hoops.*

Avoid headaches by reading your policy carefully. For instance, did you know some policies exclude “negligence”? If you left tools outside inviting trouble, your claim might be denied. Storytime: I once got dinged because I didn’t lock my bike properly—I thought vandalism was all-or-nothing. RIP $300 repair costs.

Step-by-Step Guide to Filing a Vandalism Claim

- Document Everything: Take photos, jot down details, gather witness info. Think CSI-level meticulousness.

- Contact Authorities: File a police report ASAP. Insurers love official records as proof.

- Notify Your Insurer: Don’t wait weeks—call them within 24 hours.

- Submit Required Docs: Forms, receipts, estimates… whatever they ask for.

- Follow Up Regularly: Claims adjusters aren’t always speedy. Be polite but persistent.

Best Practices for Smooth Legal Recourse

No one likes surprises during a claim process, so here are battle-tested tips:

- Review Your Policy: Seriously—it saves heartache later.

- Keep Records: Save emails, texts, receipts. Screenshot every interaction.

- Don’t Admit Fault: Even casually saying “Maybe it was my fault…” can kill your case.

- Hire an Attorney (if Necessary): Sometimes insurers play hardball. Get backup.

Beware: Some people suggest withholding information from insurers thinking it’ll speed things up. BAD IDEA. They find out eventually, and then you’re toast.

Real-Life Examples & Case Studies

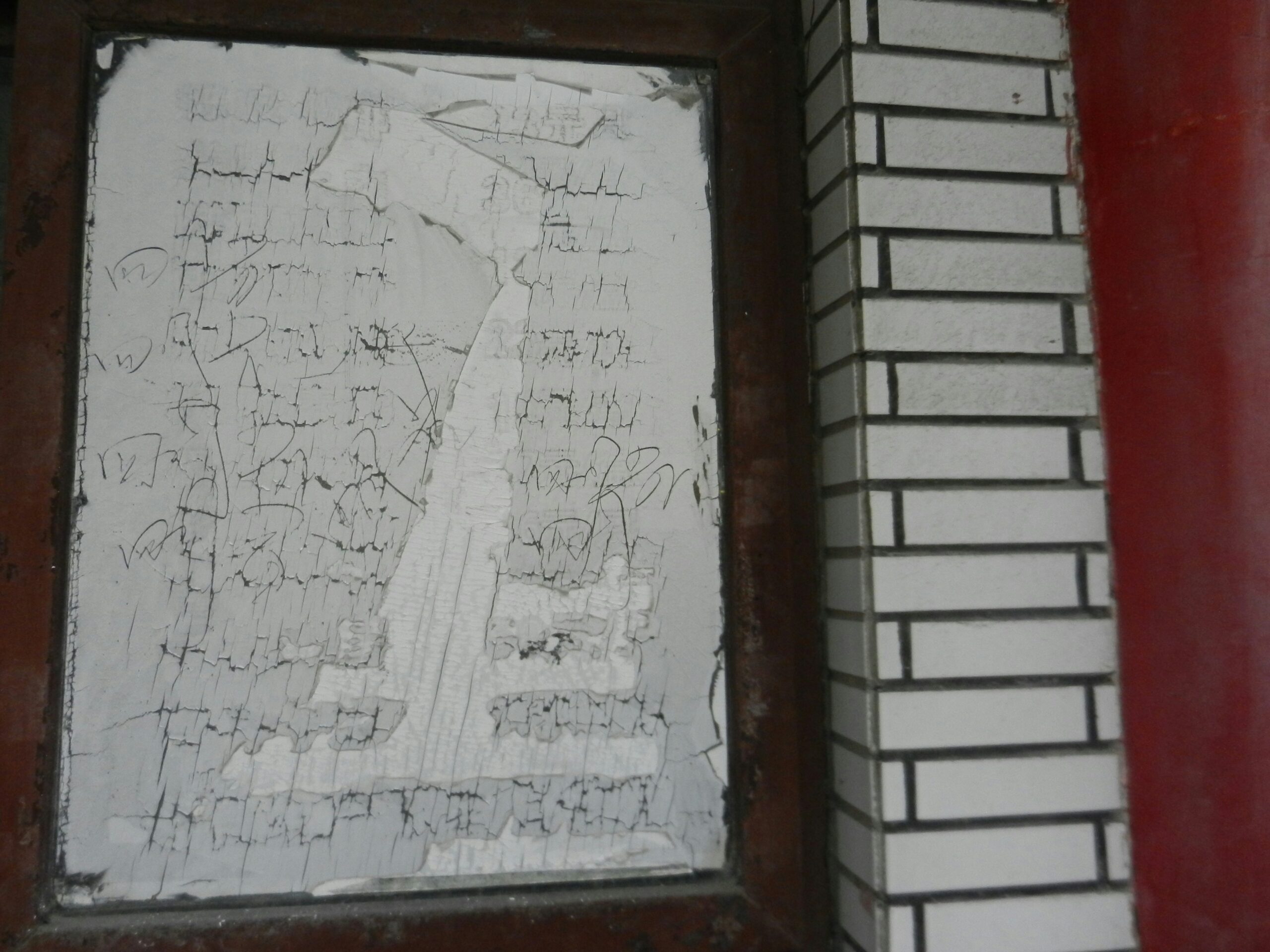

Meet Sarah. When vandals trashed her rental property window, she initially panicked—but having good documentation made filing a claim smooth. She took photos immediately, kept tenants’ payment receipts, and followed insurer instructions meticulously. Result? Full reimbursement minus her deductible.

Conversely, Mike learned things the hard way. He ignored documenting small acts of vandalism until culminating in major theft. Without clear timeline evidence, his insurer rejected part of his claim. Ouch.

Lessons Learned: Act early, document relentlessly, keep calm under pressure.

Frequently Asked Questions (FAQs)

Q: Can I use my credit card’s purchase protection for vandalized items?

Absolutely! Many premium cards include coverage for damaged goods. Check your benefits package.

Q: What counts as vandalism under my policy?

Policies vary, but general examples include spray paint graffiti, broken windows, or intentional scratches.

Q: How long does a vandalism claim take?

Typically 2-4 weeks, though complex cases stretch longer.

Conclusion

Navigating Legal Recourse FAQs isn’t just about surviving financial disasters—it’s about thriving despite them. With solid understanding of vandalism insurance basics, actionable steps for filing claims, insider best practices, and real-world lessons, you’re armed to handle anything thrown your way.

Remember, like debugging code late at night with caffeine fueling your brain, persistence pays off.

And hey—don’t forget sunscreen tomorrow.

(P.S. Like Frosted Flakes cereal commercials from the ’90s, double-check EVERYTHING before making moves.)