Ever wake up to find your car keyed, your windows smashed, or your home graffiti-covered? You’re not alone. Every year, vandalism costs property owners billions of dollars—and that’s before you factor in the emotional toll. But here’s the kicker: Did you know many victims of vandalism can file civil lawsuits against vandals and recover damages?

In this guide, we’ll break down how vandalism impacts your finances, why vandalism insurance matters, and how you can turn the tables on vandals through civil lawsuits. You’ll learn practical steps to seek justice, plus tips for making vandalism less of a headache.

Table of Contents

- Key Takeaways

- The Real Cost of Vandalism

- How to File Civil Lawsuits Against Vandals

- Tips for Maximizing Your Vandalism Insurance

- Real-Life Wins Against Vandals

- FAQs About Civil Lawsuits and Vandalism Insurance

Key Takeaways

- Filing civil lawsuits against vandals can help you recoup financial losses.

- Vandalism insurance is a lifeline for covering repair costs—but it doesn’t cover everything.

- Documenting damage meticulously is critical for both claims and lawsuits.

- Legal action may be necessary if insurance falls short or the vandal refuses accountability.

The Real Cost of Vandalism: Why It Matters

Imagine coming home after a long day at work only to discover someone spray-painted your garage door neon green. While cleaning supplies are cheap, what about replacing shattered windows, scratched cars, or damaged appliances? I once spent three months arguing with an insurance company over a $500 repair bill because they claimed I didn’t report “adequate proof.” Spoiler alert: They were wrong, but boy, was it exhausting.

Vandalism isn’t just messy—it’s expensive. According to the FBI, property crimes like vandalism cost Americans over $16 billion annually. And those numbers don’t even include the stress headaches!

So, where does vandalism insurance fit into the equation? Think of it as your first line of defense—a financial buffer that softens the blow. But what happens when insurance companies lowball you or deny your claim altogether? That’s where civil lawsuits come in handy.

How to File Civil Lawsuits Against Vandals

Filing a lawsuit sounds intimidating, right? Let me demystify the process step by step:

Step 1: Document EVERYTHING

The more evidence, the better. Snap clear photos from multiple angles. Write down timestamps. Gather witness statements. Grumpy Optimist Dialogue Ahead:

Optimist You: “This will make my case ironclad!”

Grumpy You: “Ugh, yes—but good luck finding witnesses who care.”

Step 2: File a Police Report

No police involvement? No lawsuit—period. A formal report provides vital documentation and increases credibility in court.

Step 3: Consult an Attorney

Hiring a lawyer might seem pricey upfront (like that time I splurged on a designer coffee machine), but trust me—it pays off. A pro ensures you’re filing the right paperwork and avoids rookie mistakes.

Step 4: Prepare for Court

If mediation fails, brace yourself for court appearances. *Whirrrr*. Sounds like my laptop fan during a Zoom marathon.

Tips for Maximizing Your Vandalism Insurance

- Review Coverage Limits: Double-check whether your policy includes vandalism explicitly.

- Beware of Exclusions: Some insurers exclude certain kinds of vandalism, which stinks, honestly.

- Avoid Terrible Tips: Don’t delay reporting damage—it could void your claim entirely.

- Compare Quotes Regularly: Shopping around might save hundreds yearly.

Real-Life Wins Against Vandals

Take Sarah, a small business owner whose storefront was repeatedly defaced. After her insurer denied coverage due to insufficient evidence, she pursued a lawsuit. With ample documentation, she won $10,000 in damages from the perpetrator.

Image: Sarah’s restored storefront post-vandalism repair.

FAQs About Civil Lawsuits and Vandalism Insurance

Can I Sue Without Proof?

No. Evidence is non-negotiable.

What If the Vandals Are Minors?

Parents are often held liable for their children’s actions. Lawyer up!

Will My Rates Increase if I File a Claim?

Possibly—but fighting vandalism shouldn’t bankrupt you either.

Conclusion

Vandalism hits hard financially and emotionally. Whether you lean on vandalism insurance or take vandals to civil court, knowing your options helps protect your assets and peace of mind. Remember, preparation beats panic any day.

Before you go, here’s a little something to brighten your day:

Spray paint fades, Courts deliver justice loud, Finances repaired.

Like a Tamagotchi, your personal finance health requires constant care. Now get out there and conquer those vandals!

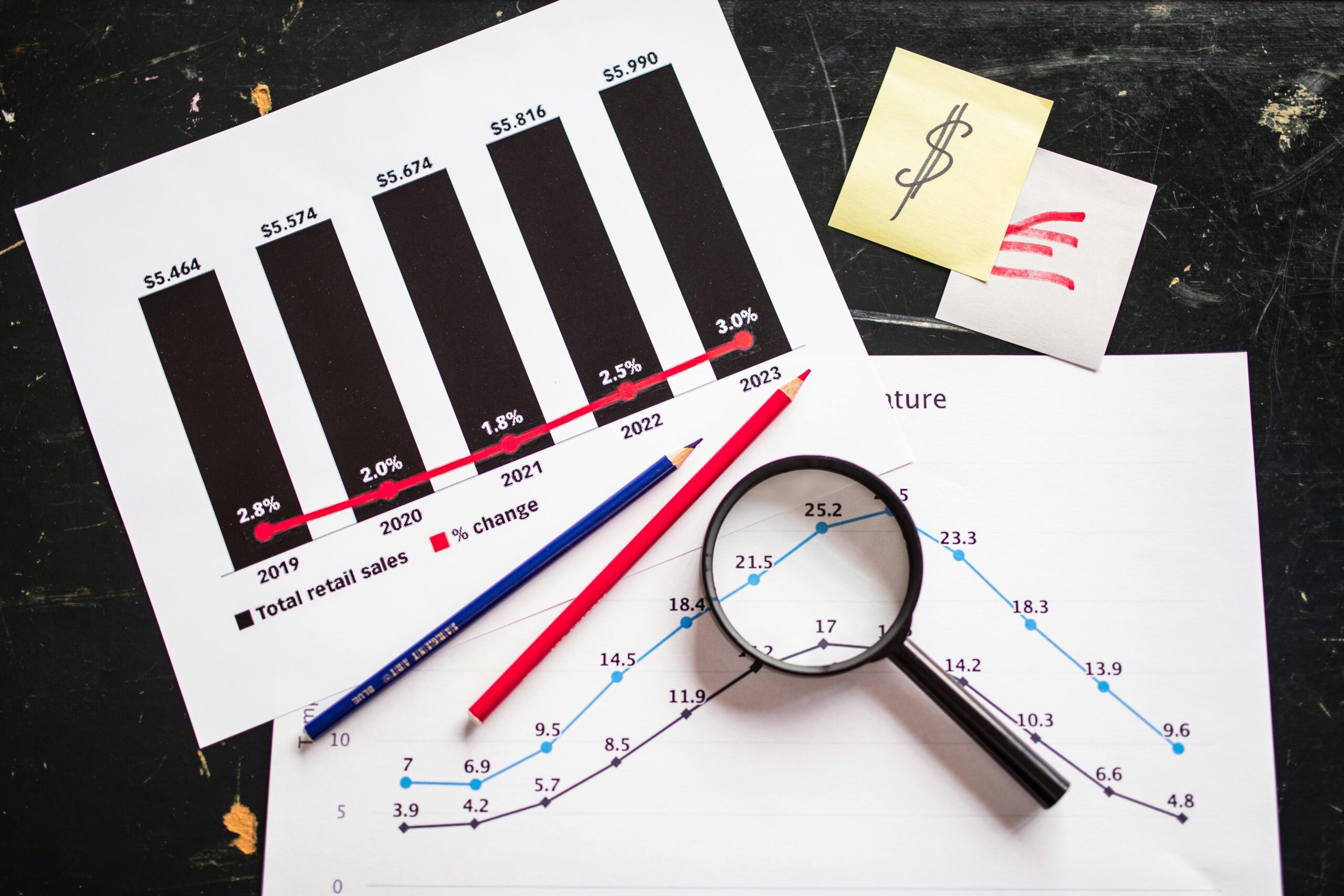

Image: Infographic illustrating vandalism cost statistics across the U.S.

Image: Flowchart explaining how to navigate vandalism insurance claims effectively.